Sales Tax Compliance Services

Sales tax compliance extends beyond completing and filing tax returns.

Sales tax compliance extends beyond completing and filing tax returns. When many clients approach Agile about getting assistance with their sales tax compliance, they are in the nascent or very early stages of considering their sales tax compliance obligations. If your company is further along in considering their sales tax compliance obligations, Agile can pick up at the appropriate step and help you to continue to move forward.

It's Time to Get Started!

Benefits of Agile's Comprehensive Sales Tax Compliance Solution.

Staying tax compliant is time-consuming and stressful – unless a sales tax expert is on your side.

Comprehensive sales and use tax compliance reporting

A full monthly review of transactions to successfully and timely file monthly, quarterly, semi-annual and annual tax returns.

Review monthly filings and correct errors

Our years of experience allow us to focus our attention on the problem areas. Sales tax software is great, but imperfect. Our specialists review all transactions manually to ensure compliance.

Stay abreast of current nexus thresholds and standards

We monitor your transactions to make sure you remain compliant with any sales and use tax obligations.

Monitor vendor invoices for sales tax overpayments and potential liabilities

In-depth knowledge of sales and use tax laws to identify transactions qualifying for exemptions or subject to use tax.

Proactively prepare for sales and use tax implications of major transactions

Your outsourced sales tax team will research applicable tax laws to keep you informed of the proper taxability of large purchases.

Support client through any state or local sales tax audits

Experienced sales tax consultants ready to assist. Eight hours of complimentary audit assistance provided to all compliance clients.

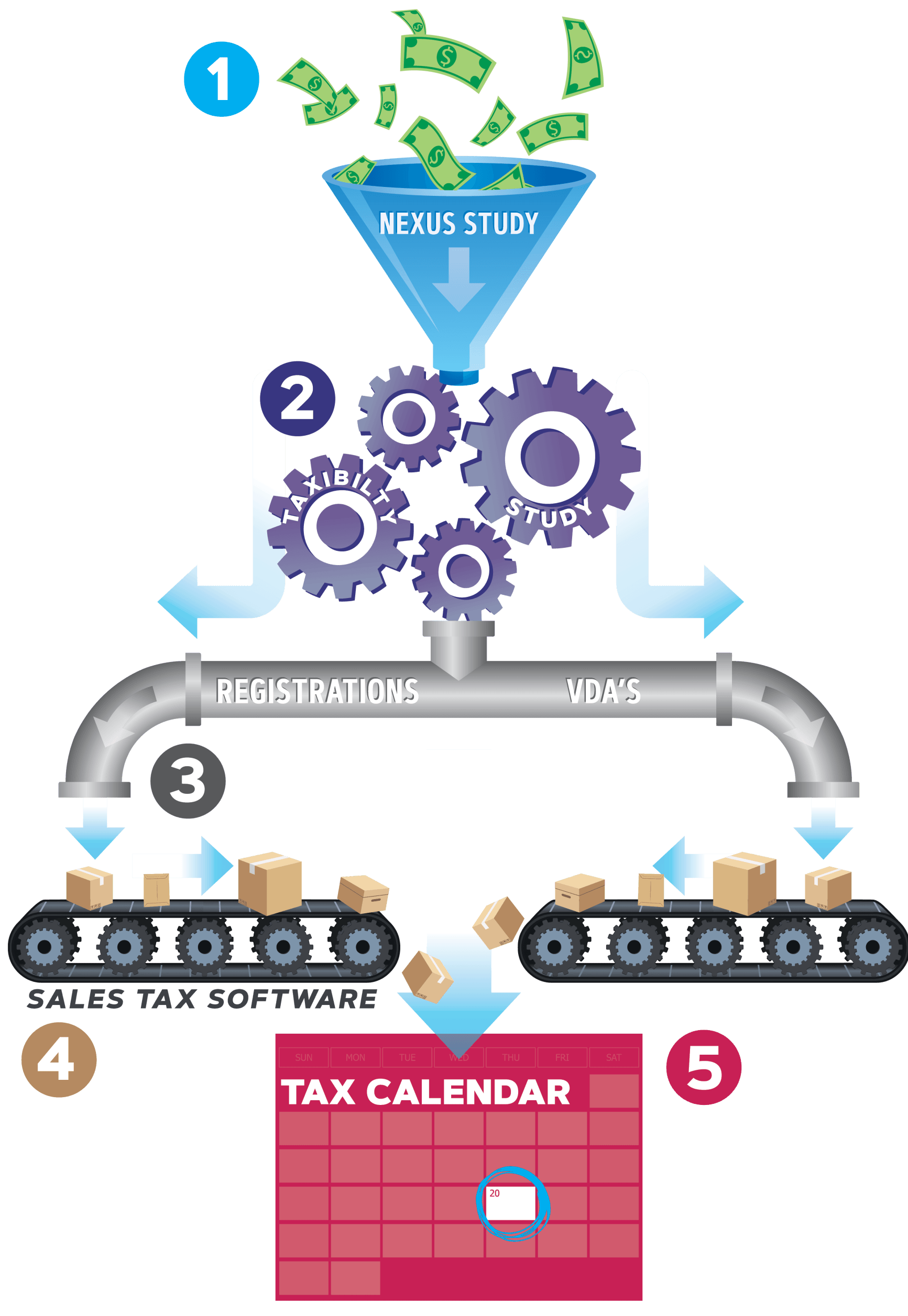

Agile's 5 Steps to Compliance Mastery

Agile has developed a five-step process of aligning your company’s tax and accounting systems with current sales and use tax laws to help it become and remain compliant with your ongoing sales and use tax collection, reporting and filing obligations.

Ongoing Outsourced Sales Tax Compliance Filings

The greatest opportunity – and biggest hurdle – lies in identifying the appropriate figures to be reported on sales tax compliance returns and getting those figures into the appropriate fields on each return. This is where we shine. Our greatest strength lies in reviewing and validating the data used to populate sales tax compliance filings. As a result of our sales tax consultants attention-to-detail and years of experience, we developed a comprehensive sales tax compliance outsourcing program.

We START with the numbers.

Superb problem solving and critical thinking skills paired with an avid attention-to-detail, enables the Agile sales tax consulting team to identifies accurate figures. After completing adequate prep work, populating and filing a sales tax return with optimal numbers is seamless. Knowing where the most likely areas for misapplication of jurisdictions rates is key. The software solutions in the marketplace cannot do so as accurately as a seasoned tax professional.

We PARTNER with your business

In-house tax departments spend the majority of their time devoted to compliance. Taxpayers without in-house sales tax assistance pass these important duties on to whomever is best suited or has time available to complete the filings. In these cases, we often find accounts payable staff, controllers or even CFO’s tasked with filing sales tax returns. At Agile, our sales tax consultants and compliance experts serve as a cost-effective extension of your business, saving valuable labor hours and allowing your in-house staff to to focus on their specialties and higher leverage initiatives.

We are the EXPERTS

The thought of making a sales tax compliance filing mistake is frightening. We provide businesses peace of mind, knowing their tax returns are in the hands of experts with years of industry experience. We file thousands of returns on a monthly basis. Rest assured, there is no challenge or problem in sales tax compliance that we haven’t seen and overcome before.

What Our Clients Say

Sales Tax Compliance FAQs

Sales tax compliance can be intimidating, but it doesn't have to be!

Latest Insights

Find the sales tax exemptions for your state

We’ve compiled state-specific research regarding the sales and use tax exemptions available in each state. You’ll also find helpful links to sales and use tax related content for each state revenue agency.