What is a sales tax nexus study?

A sales tax nexus study is an evaluation of your business’s characteristics, sales volumes and transaction count to determine the states in which you have an obligation to:

- Register for sales tax.

- Begin collecting sales tax on sales determined to be taxable in that state.

Sales tax nexus by state can be confusing for taxpayers because the sales tax nexus requirements by state are different. There are 45 U.S. states plus the District of Columbia that have sales tax. We’ll get into a discussion of the different nexus triggers below, but let’s keep it high level at this point and simply say that different states have different standards for what triggers sales tax nexus.

Ready to get started? Speak with an expert!

What is sales tax nexus?

Sales tax nexus is the responsibility of a business to comply with sales tax laws within a state. At any point, a business can opt to voluntarily register for a sales tax license, but along with that license comes the ongoing and recurring expectation to file sales tax returns. To avoid the unnecessary administrative burden of filing sales tax returns, most businesses delay their sales tax registration decision until they are required by a state to be in possession of a sales tax license. There are two different standards or triggers that would require a business to register within a state for a sales tax license.

National Recognition for Growth & Excellence

As a 2025 Inc. 5000 honoree, Agile Consulting Group stands among the nation’s most dynamic private companies, delivering measurable results for our clients year after year.

What are the two types of sales tax nexus?

Businesses, which have:

Physical Nexus

The physical nexus definition for sales tax is the legacy standard that has existed since the Quill v. North Dakota ruling issued by the U.S. Supreme Court in May 1992. In that case, the Supreme Court ruled that in order for a business to have an obligation to complete a sales tax registration and to begin collecting sales tax on taxable sales, the business had to have a physical presence within the state. A physical presence can be:

- A physical location including an office, warehouse, building, or other place of business

- Inventory in a warehouse, even if the warehouse belongs to a 3rd party

- Employees, including those working from a home office

- Traveling salespeople (depending upon the number of days spent within a specific state)

- An independent contractor, but only if that contractor is working in a sales or marketing capacity

The physical nexus standard still exists; however, it is no longer the only determining factor as to whether a business has sales tax nexus on a state-by-state basis.

Economic Nexus

The economic nexus definition for sales tax is a more recent concept that was created as a result of the South Dakota v. Wayfair ruling by the U.S. Supreme Court in June 2018. Essentially, the Court said that the world has changed significantly in the years since the Quill ruling. Based on the rise of the internet and e-commerce, gone are the days when a business needed to have “boots on the ground” in a state to generate a significant volume of sales.

As such, the Court found that it was reasonable and appropriate that businesses that exceeded a certain threshold of sales within a state had an obligation to help that state generate revenue via sales tax collection activities. That means that any business that exceeds the economic nexus threshold in a state is required to complete a sales tax registration and to begin collecting sales tax on all taxable sales. This is the nexus standard that causes the greatest concern for e-commerce businesses, online retailers and remote sellers.

Why does my business need a sales tax nexus study?

A sales tax nexus study provides a business with the answer to where it has created sales tax nexus by state. A sales tax nexus study informs the business of their obligations related to sales tax registration and collection on a go forward basis. The nexus study should also provide clarity to when those obligations began and the potential back sales tax owed from prior periods if sales tax nexus has been previously triggered in any states. We then display your sales data alongside the relevant information for each state, provide recommendations for options to become compliant as well as best practices to remain compliant going forward. Agile’s sales tax nexus studies also explain:

- The economic nexus thresholds by state

- When each state’s economic nexus rules were enacted

- Which type of sales each state measures with regard to its’ thresholds

- The timeline of when a business is expected to register for a sales tax license upon exceeding the state’s economic nexus threshold

What is the sales tax economic nexus threshold?

It is important to note that while the most popular and lowest sales tax nexus threshold in the U.S. is $100,000 in annual sales or 200 separate transactions within a calendar year, it is not that simple as the states’ economic nexus thresholds vary. Some states measure gross sales, others only count retail sales and still other states measure taxable sales. Additionally, a business’s obligations of when it must register and begin collecting sales tax once they have reached the threshold also vary.

Some states say that sales tax collection should begin on the next transaction, other states say the beginning of the next month, still others say the beginning of the subsequent quarter and yet there are also some states that require sales tax collection to begin by the first day of the next calendar year. It’s all quite confusing and makes U.S. sales tax a significant challenge for businesses that want to become and remain compliant.

Agile Consulting's Two Options for Sales Tax Nexus Study

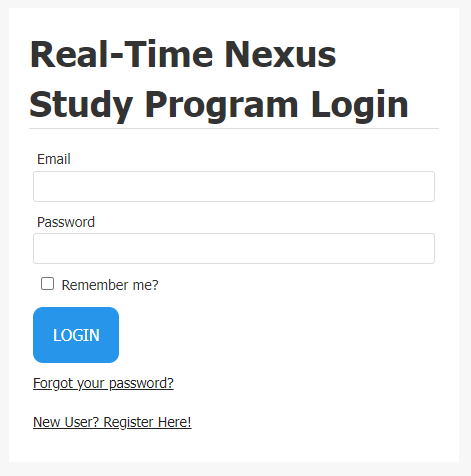

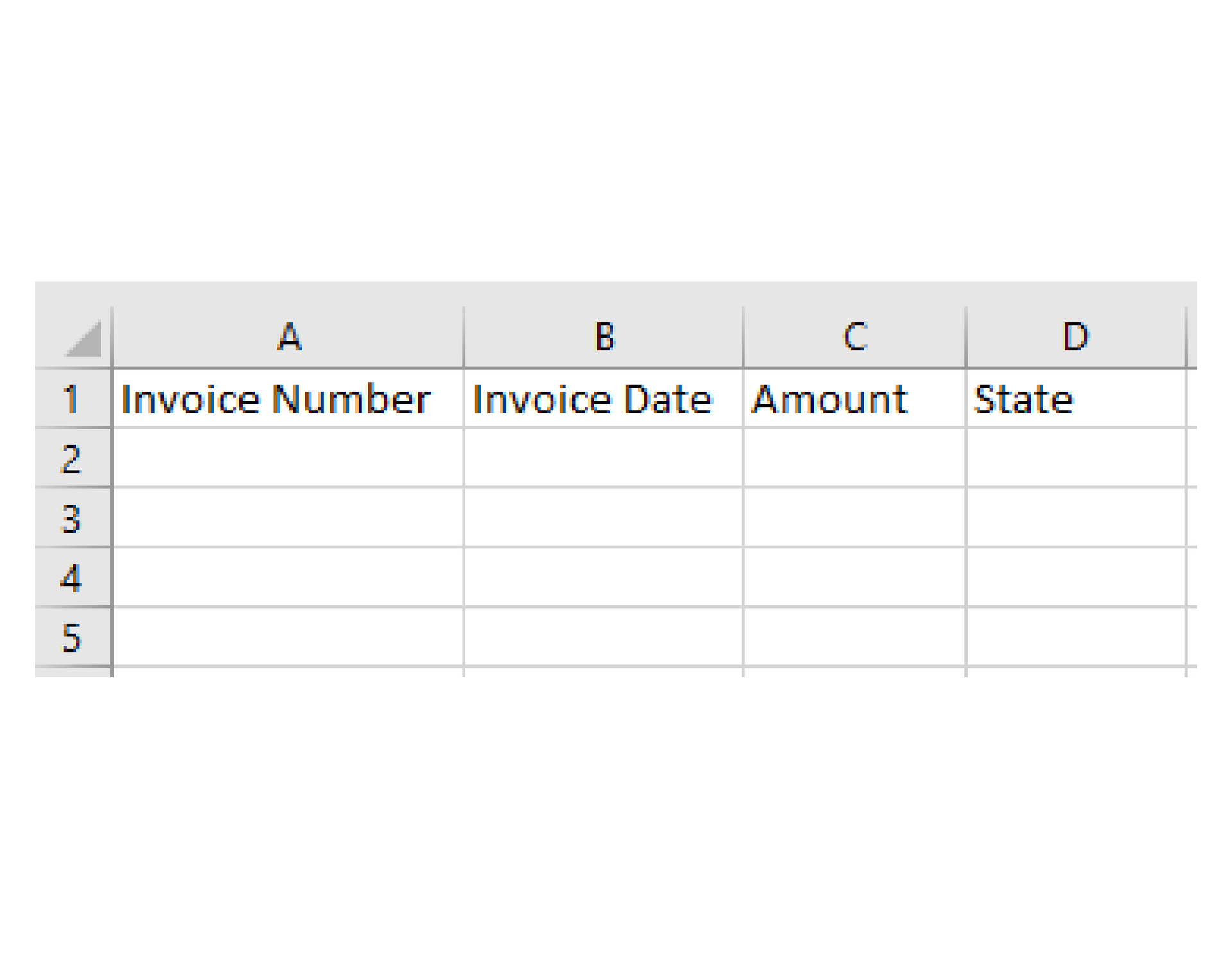

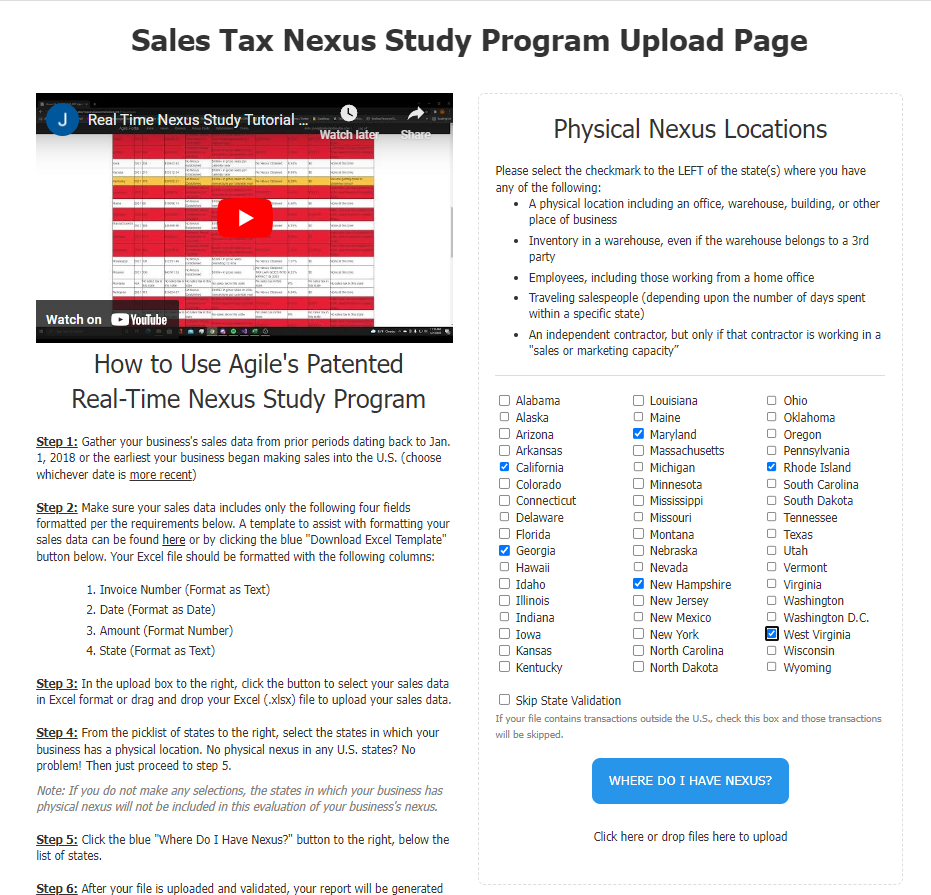

Agile's Patented, Real-Time, Instant Nexus Study

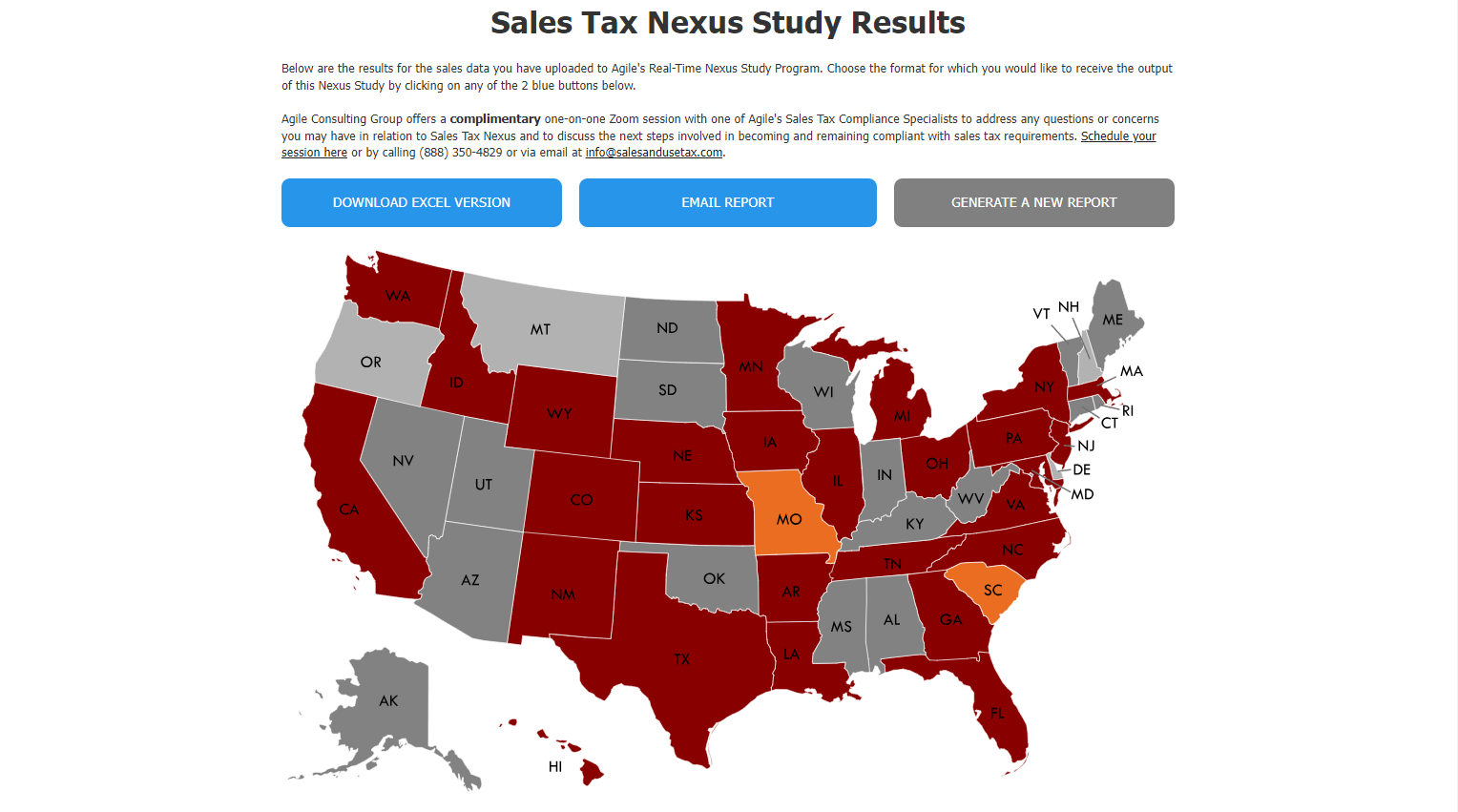

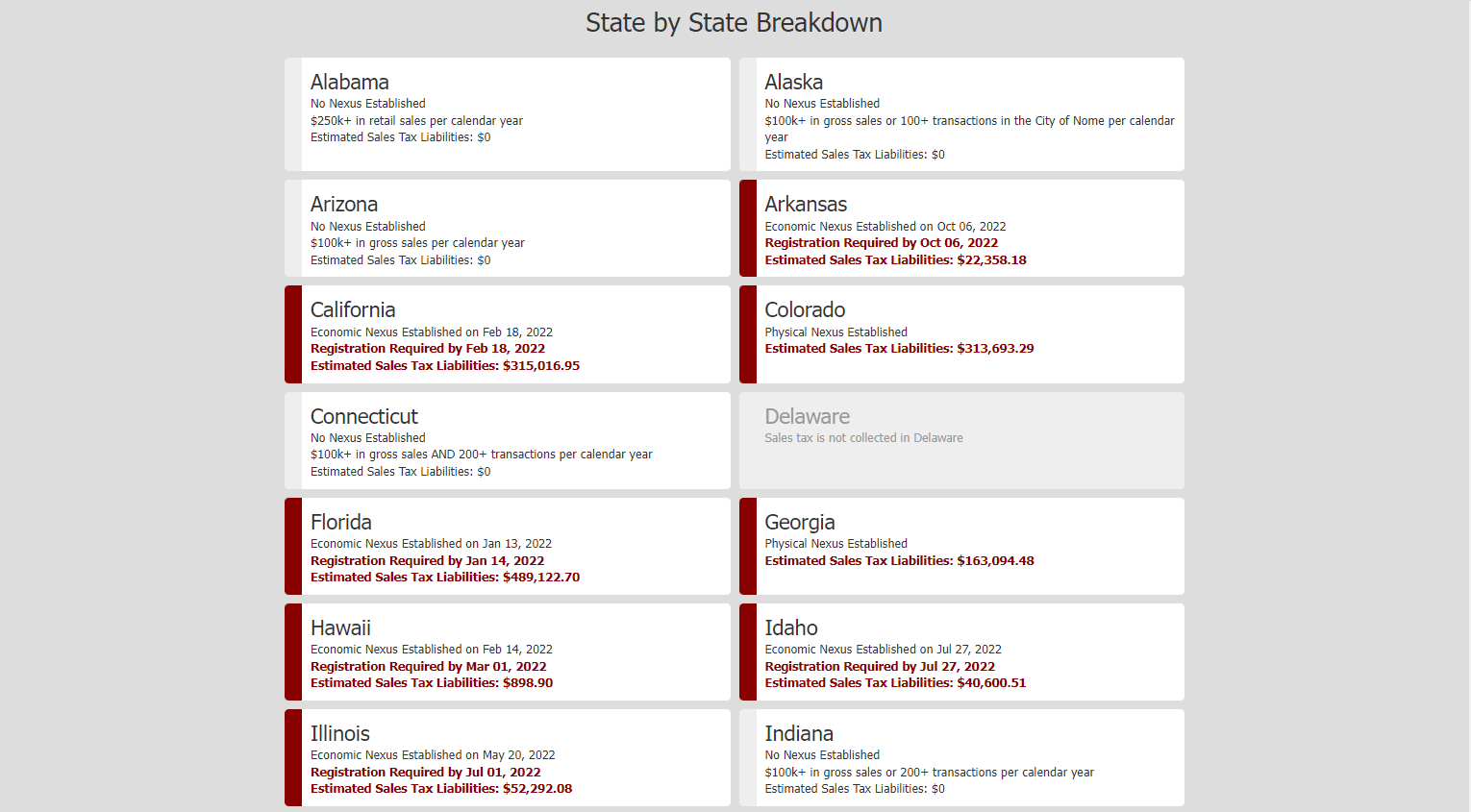

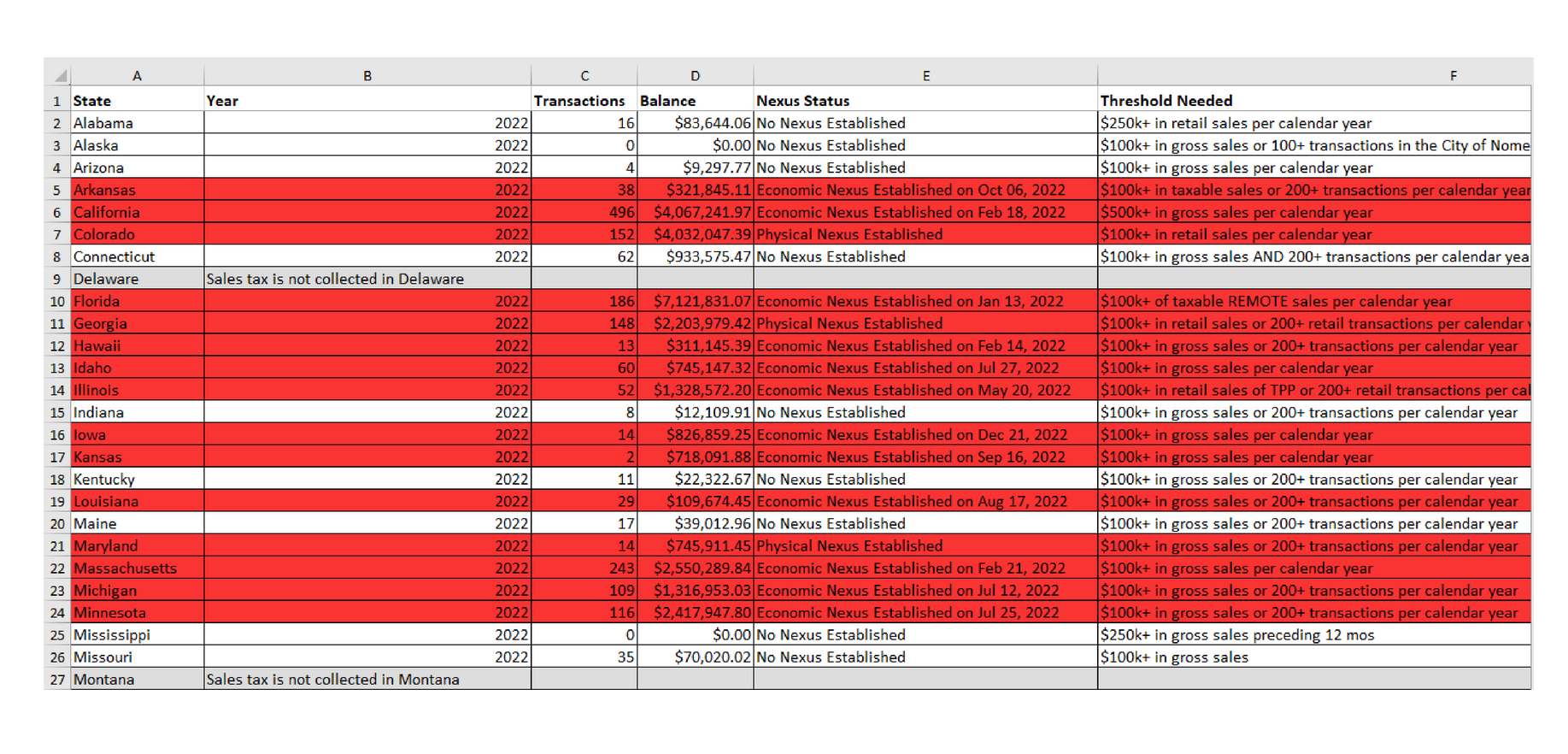

Agile has developed a patented, real-time nexus study that provides instant results unique to your business within a matter of minutes, because who likes waiting? Gather your sales data and upload it into Agile’s nexus study application. Within minutes, you have your answer about where your business has triggered sales tax nexus. We simply need 4 columns of data including: invoice date, invoice number, invoice amount, and the state the sale was sourced to or shipped into. We provide an Excel template to format your data. Your results are shown overlaid on a color-coded map showing which states your business has established nexus within, and unique results derived from the whole of your sales data.

We also include your sales data alongside each state’s nexus rules and thresholds in an Excel spreadsheet. Even if your business has not yet established sales tax nexus within a state, the output of this report shows you what those thresholds are. In addition to the report, we include a complimentary one-on-one Zoom session with one of Agile’s Sales Tax Compliance Specialists to address any questions or concerns you may have in regarding sales tax nexus, and an opportunity to discuss the next steps involved in becoming and remaining compliant with sales tax requirements.

Turnaround Time: Instant!

Rate: $999.99 for unlimited use over a 12-month period so you can re-run your data as your business grows.

Manual Study Completed by Agile's Sales Tax Compliance Specialists

You share your business’s sales data with Agile’s team of Sales Tax Compliance Specialists and we take it from there! We need the same 4 columns of data including: invoice date, invoice number, invoice amount, and the state the sale was sourced to or shipped into. We prepare a presentation explaining the states in which you have triggered sales tax nexus, or are close to doing so and the implications and responsibilities that come along with those developments.

During that meeting, we consult with you to address any questions or concerns you may have in relation to sales tax nexus. Agile’s seasoned sales and use tax experts walk you through the typical process most companies progress through step-by-step so that you feel completely comfortable about the next steps along the journey to become and remain compliant with sales tax requirements. In addition, we share a handy, color-coded map showing which states your business has established nexus within, and unique results tailored from your sales data alongside each state’s nexus rules and thresholds to distribute amongst your team to drive conversations and strategic planning in regard to sales tax.

Turnaround Time: Results presented within 5 business days of receipt of your business’s sales data.

Rate: $1,299.99

Do you have more questions about sales tax nexus and its implications for your business?

Additional advice from Agile Consulting Group’s sales tax consultants can be found on our page covering sales tax compliance. If you have questions, comments or would like to discuss the specific circumstances your business is encountering in regard to sales tax nexus or any other sales and use tax issue, please contact a member of Agile Consulting Group’s sales tax consulting team at (888) 350-4TAX (4829) or via email at info@salesandusetax.com.

Find the sales tax exemptions for your state

We’ve compiled state-specific research regarding the sales and use tax exemptions available in each state. You’ll also find helpful links to sales and use tax related content for each state revenue agency.