Sales & Use Tax Consulting

Why Sales and Use Tax Consulting Matters for Businesses

At Agile Consulting, we believe that the only constant is change – especially with respect to sales and use tax laws. Sales and use tax rules and regulations are always evolving and growing more complex. At the same time, tax audits are becoming more frequent.

As sales and use tax specialists, we are a supplementary resource to our clients’ operations regardless of whether they have an in-house tax team, no prior experience dealing with sales and use tax or fall somewhere in between. We provide a turnkey solution for our clients come alongside organizations as experienced advocates to align their tax and accounting systems with current tax laws, correct past errors, recover money lost in unwarranted overpayments by correcting prior errors, and eliminate future overspending.

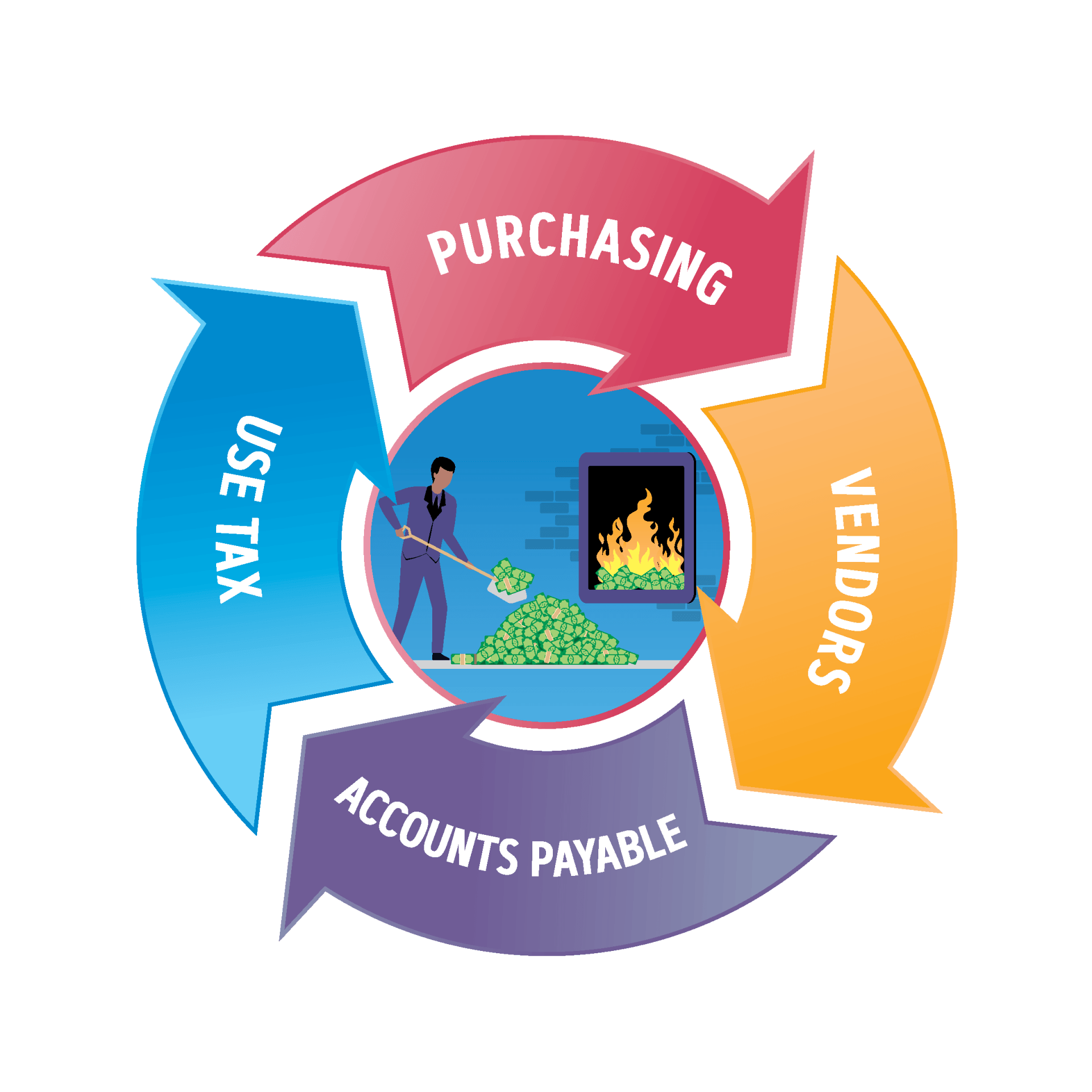

Opportunities for sales tax overpayments occur at several stages in the purchasing cycle for businesses.

The numbers you need to know

1,635+

Completed Projects

21.6%

Average Client Savings

62.3

Average Turnaround Time (in days)

44

States with Experience

Our Sales & Use Tax Consulting Services

Sales Tax Consulting

Recover sales tax refunds. Our core competency.

Maximize the benefit of the exemptions you qualify for; minimize overpayments.

Use Tax Consulting

Recover use tax refunds; another core competency.

Maximize the benefit of the exemptions for which you qualify and minimize overpayments.

Sales Tax Training & Research

Stay up-to-date.

Ensure your in-house staff is well-versed in current sales and use tax laws.

Why Choose Agile Consulting Group

Our pioneering efforts recover lost sales and use tax refunds – more than our competitors – because we think “outside the box” instead of merely pursuing the easiest, low-hanging fruit. We are constantly innovating and driving the sales and use tax industry forward.

At Agile Consulting, we distinguish ourselves in three key ways.

One.

We look to develop new approaches to maximize existing exemptions, present more appropriate and beneficial interpretations of current tax law, and identify changes in tax laws so we can be first-to-market with solutions.

Two.

We believe in continuous improvement and strive to be better tomorrow than we are today in all that we do.

Three.

Our team is transparent and eager to share our knowledge with every client so they can leverage the improvements and 100% of future savings accrue directly to their bottom-line results.

Find the sales tax exemptions for your state

We’ve compiled state-specific research regarding the sales and use tax exemptions available in each state. You’ll also find helpful links to sales and use tax related content for each state revenue agency.