Iowa Sales Tax Exemptions

What is Exempt From Sales Tax In Iowa?

The rate of Iowa’s state sales tax increased to 6% beginning July 1, 2008. Sales tax is due on the retail sale, lease or rental of most goods and some services. Local jurisdictions may impose an additional local option tax of 1%.

Use tax is also collected on the consumption, use, or storage of goods in Iowa if sales tax was not paid on the purchase of the goods. The use tax rate is the same as the general sales tax rate. Returns are to be filed on or before the 20th day of the month following the month in which the purchases were made. For example, purchases made in the month of January should be reported to the state of Iowa on or before February 20th.

Need more information?

For more information on Iowa sales tax exemptions, please visit the sites below.

Iowa Sales Tax Exemptions Information

Iowa Sales Tax Research Bulletins

Sales Tax Compliance FAQs

Sales tax compliance can be intimidating, but it doesn't have to be!

Iowa Sales Tax Compliance Details

Here is useful Iowa sales tax compliance information our Agile team members felt could be helpful:

Reduced Rates & Exemptions

- Motor Vehicle registration is exempt from sales tax.

- Motor Vehicle registration is subject to a 5% new registration fee.

- Hotels and motels have a 5% state excise tax on lodging.

- Local hotel and motel tax can range from 1% to 7%.

- Iowa sales tax compliance does not offer vendor compensation, vendor discounts, or timely filing discounts.

Local Taxing Jurisdictions

- Iowa has 99 total local county taxing rates.

- Local tax rates are either 0% or 1% in addition to the state-wide tax rate of 6%.

Sales Tax Compliance

- Four filing frequencies: semimonthly, monthly, quarterly, and annually.

- Quarterly tax returns due by the last day of the month in the month after the reporting period.

- Annual filers' returns due on January 31st.

- Monthly taxpayers submit pre-payments for the first two months of the quarter on the 20th of the month after the reporting period.

- Semi-monthly taxpayers with over $60,000 in tax liability per year have two pre-payment dates each month.

Due Dates

- If the return due date falls on a weekend or national holiday, it is pushed back to the next business day.

- Monthly pre-payments due on the 20th.

- Final quarterly return due on the last day of the month following the reporting period.

- Pre-payment due dates are considered the most challenging part of Iowa sales tax compliance.

How to Calculate Iowa Sales Tax?

Utilize the following sales tax formula to obtain the necessary sales tax:

Sales tax = total amount of sale x sales tax rate

If you are looking for more information, check out our Sales Tax Consulting page or talk to one of our Experts:

Find the sales tax exemptions for your state

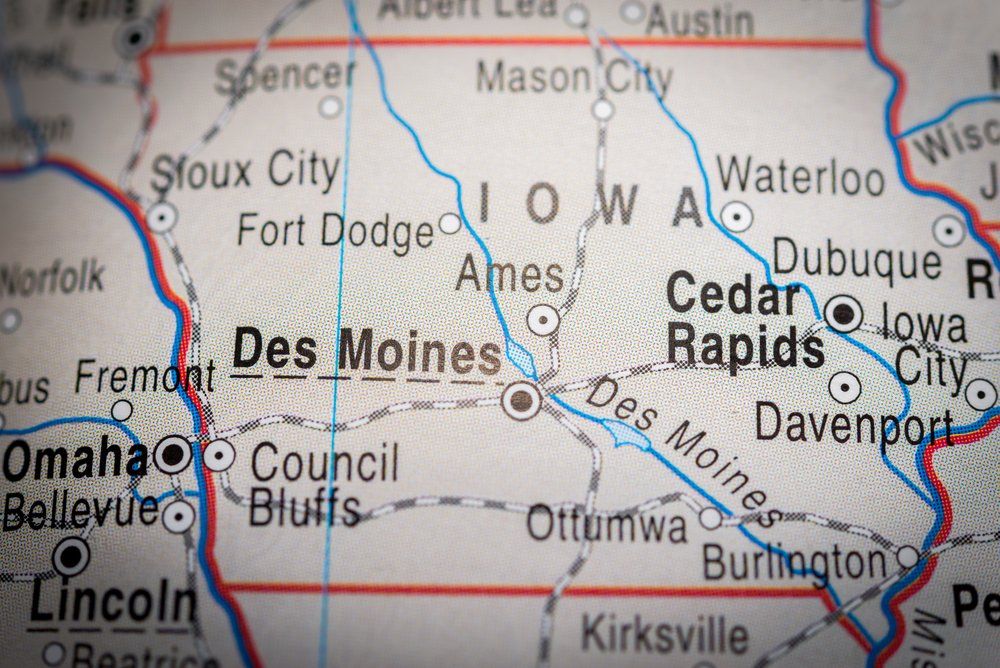

Select any state in the map below to view all relevant sales and use tax information available for that state.