Business Personal Property Tax Consultant

Mike Martin

Business Personal Property Tax Specialist

Minimize Your Annual Property Tax Burden

Manufacturers, in states that tax business personal property or industrial property for ad valorem tax purposes, often overlook opportunities to minimize their annual property tax burden. States and local taxing jurisdictions, usually counties, estimate market value each year of business personal property/industrial property, by using depreciation factors to estimate the wear and tear of machinery and equipment. M&E that is one year old will have a deprecation factor of maybe 0.95 applied to the historical cost to estimate the current year’s value while equipment that is 20 years old will have a depreciation factor of maybe 0.10 applied to the equipment’s historical cost to estimate the current year’s value. This all seems very reasonable to estimate normal wear and tear, but these depreciation factors due a poor job of estimating external factors beyond normal physical depreciation of machinery & equipment. These depreciation factors are stable and don’t change each year.

Contact our business personal property tax consultant

today!

"Take an adjustment due to Economic Obsolescence"

So, what happens when external factors, such as a recession or an industry slowdown, negatively impact the income-producing ability of M&E? These depreciation factors are the same each year whether the plant is operating at capacity or if the plant is just operating at 60% of capacity. Most states and local taxing jurisdictions will allow taxpayers to take an additional adjustment due to “Economic Obsolescence” – but the taxpayer will have to provide clear proof of economic obsolescence before the state/county will allow an additional adjustment.

The numbers you need to know

1,635+

Completed Projects

21.6%

Average Client Savings

62.3

Average Turnaround Time (in days)

44

States with Experience

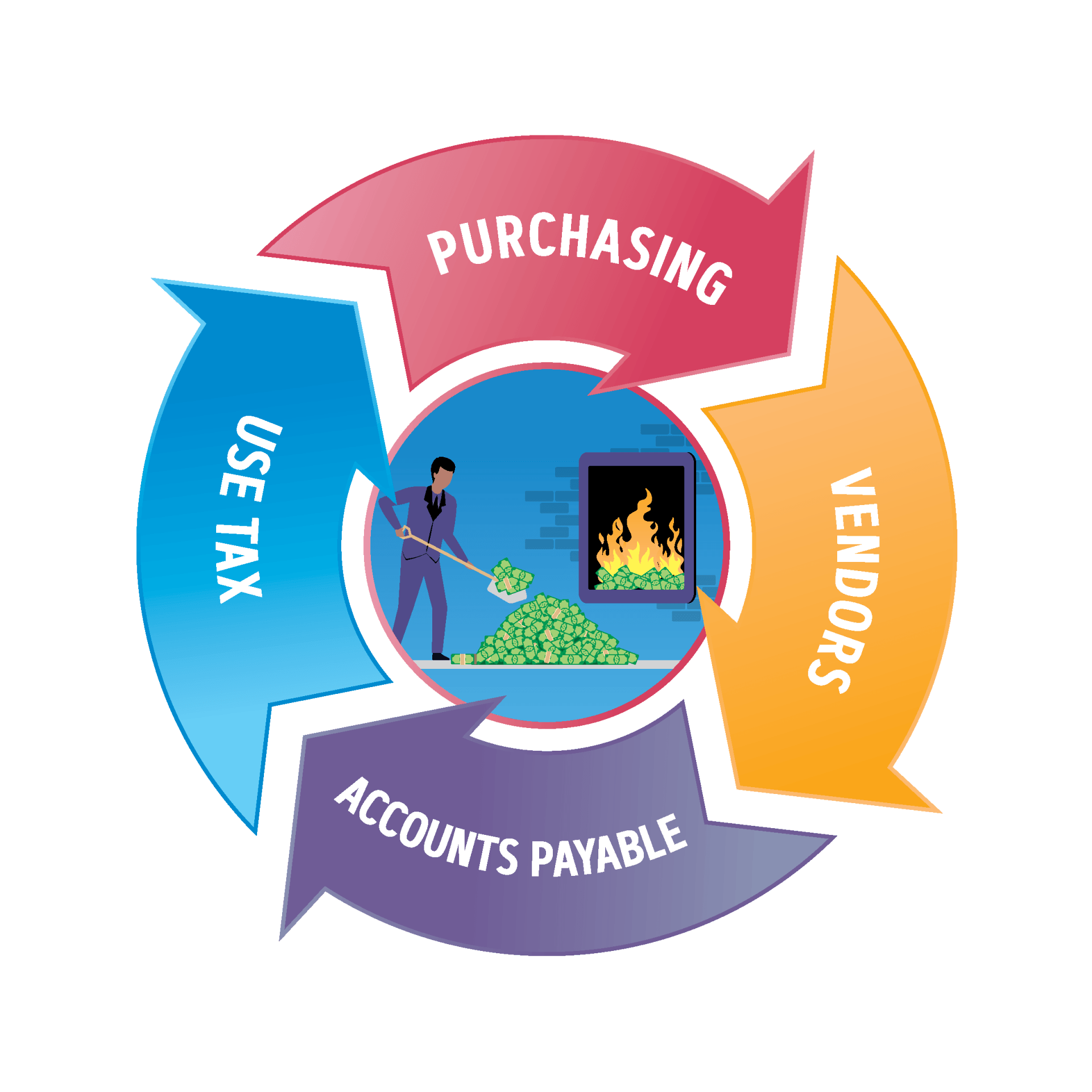

Our Sales & Use Tax Consulting Services

Identifying Exempt Business Personal Property

At the Agile Consulting Group, we have experience documenting Economic Obsolescence and can help manufacturers with their request for an additional value adjustment. We also have experience identifying exempt business personal property and can prepare tax refunds in instances where exempt M&E was included on past annual returns in error. We have assisted lumber mill clients, coil coaters, auto parts manufacturers, and packaging parts manufacturers with both economic obsolescence studies and exempt personal property tax refund reviews.

Why Choose Agile Consulting Group

Our pioneering efforts recover lost sales and use tax refunds – more than our competitors – because we think “outside the box” instead of merely pursuing the easiest, low-hanging fruit. We are constantly innovating and driving the sales and use tax industry forward.

At Agile Consulting, we distinguish ourselves in three key ways.

One.

We look to develop new approaches to maximize existing exemptions, present more appropriate and beneficial interpretations of current tax law, and identify changes in tax laws so we can be first-to-market with solutions.

Two.

We believe in continuous improvement and strive to be better tomorrow than we are today in all that we do.

Three.

Our team is transparent and eager to share our knowledge with every client so they can leverage the improvements and 100% of future savings accrue directly to their bottom-line results.

Find the sales tax exemptions for your state

We’ve compiled state-specific research regarding the sales and use tax exemptions available in each state. You’ll also find helpful links to sales and use tax related content for each state revenue agency.